During March 2020 – at the height of the coronavirus crisis, while credit spreads grew and equity markets faltered (only to make new records later) – billionaire Bill Ackman’s hedge fund Pershing Square made $2.6 billion from hedging using credit default swaps (CDSs). Generally speaking, these credit derivatives appreciate when credit spreads go up, awarding the protection buyer compensation upon the occurrence of trigger events, such as the reference entity bankruptcy. In effect, Mr. Ackman used this credit derivative creatively to hedge an equity position. However, when the hedged position is existing debt instruments – held under a business model of collecting their principal and interest payments – there may be a mismatch between measuring the protection at fair value and measuring the backed assets, which will often be at amortised cost. In this paper, we discuss one of the unique tools provided by IFRS 9 to the protection buyer in order to mitigate such mismatch: designating the exposure as at fair value through profit or loss. This tool is provided as an alternative to hedge accounting.

1. General

Certain reporting entities may use credit derivatives such as credit default swap contracts (CDS) to manage their credit exposures (in respect of items such as loans granted, investments in debt instruments or loan commitments). Among other things, using credit derivatives may even result in an improvement in the capital adequacy of regulated entities, such as banks or insurance companies.

A credit default swap is designed to transfer the credit exposure of fixed income products from one party to another. The buyer of the swap makes payments to the swap’s seller until the maturity date of a contract. In return, the seller agrees that – in the event that the debt issuer (borrower) defaults or experiences another credit trigger event – the seller will pay the buyer the security’s par value as well as all interest payments that would have been paid throughout the remaining time to maturity. Most single-name CDSs have the following triggers relating to the reference entity: bankruptcy, failure to pay, obligation acceleration, repudiation, and moratorium.

In principle, IFRS 9 (hereinafter – the “Standard”) stipulates that for purposes of implementing hedge accounting, the credit risk component of a financial instrument may not be regarded as a separately identifiable and reliably measurable risk component. Thus, for example, let us assume that the reporting entity has a loan bearing a 5% interest. Let us also assume that the reporting entity purchases a credit derivative to hedge against all the credit losses arising from the loan. Under these circumstances, the reporting entity may not be allowed to designate the component relating to the loan’s credit risk spread as a hedged item in a fair value hedge; rather, only the total change in the loan’s fair value may be designated as such. Since the change in the loan’s fair value is also explained by other factors (specifically, changes in the benchmark interest rate environment), a significant ineffectiveness is expected to result, which will make the establishment of a hedging relationship difficult (and often even impossible). Another approach that might have improved effectiveness, but is expressly prohibited under the Standard’s explanatory notes, is an approach whereby all unidentified risks (residual risks) which do not stem from identified risks such as the benchmark interest rate and/or inflation (when it is identifiable), are defined as a hedged risk component of the debt instrument, which is meant to primarily include the credit risk.

Naturally, the prohibitions referred to above have an adverse significance for the application of hedge accounting by reporting entities using credit derivatives (such as CDS contracts) in order to manage financial instruments’ credit risks. Under such circumstances, the credit derivative is measured at fair value through profit or loss, while on many occasions the hedged item will be measured at amortised cost.

As an alternative to the application of hedge accounting, if a reporting entity uses a credit derivative that is measured at fair value through profit or loss to manage the credit risk of all, or part of, a financial instrument (which the Standard calls “credit exposure”), the Standard allows to designate the hedged financial instrument (for example, loans, investments in bonds or loan commitments) as measured at fair value through profit or loss to the extent that it is so managed (i.e., including a proportion of the instrument). It is important to note that such designation is not considered an application of hedge accounting, and is not subject to the relevant effectiveness or documentation requirements; rather, it merely serves as a practical alternative.

The Standard specifies several cumulative conditions for designation of the instrument creating the credit exposure as at fair value through profit or loss, as follows:

- The reporting entity uses a credit derivative that is measured at fair value through profit or loss to manage the credit risk of the financial instrument (for more information, see Section 2 below);

- The name of the credit exposure matches the reference entity of the credit derivative (for more information, see Section 3 below); and

- The seniority of the financial instrument matches that of the instruments that can be delivered in accordance with the credit derivative (for more information, see Section 4 below).

In contrast to the ordinary types of designation as at fair value through profit or loss, reporting entities may apply the designation at, or subsequent to, initial recognition of the financial instrument, or while it is unrecognised (for more information, see Section 5 below). Nevertheless, reporting entities should document the designation. Furthermore, in our view, reporting entities are allowed to designate the managed financial instrument even after initial recognition of the credit derivative used to hedge the credit risk exposure.

An example illustrating the accounting treatment applied to designated credit exposure appears in Section 7 below.

2. Management of the credit risk

The first condition for designation of the instrument creating the credit exposure as at fair value through profit or loss is that the reporting entity uses the credit derivative measured at fair value through profit or loss to manage the credit risk of a financial instrument. For that purpose, it is important to distinguish between a financial guarantee contract held by the reporting entity (regardless of whether it is an integral part of a financial asset) and credit derivatives. As a rule, and unlike in the case of a financial guarantee contract, credit derivatives held by the reporting entity (such as CDS contracts) may entitle it to a certain payment in the event of default of the contract’s reference entity, even if no credit losses arise. Thus, for example, the reporting entity is not necessarily required to hold an investment in certain loans or bonds in order to purchase a CDS contract relating thereto, and it may even sell each of the said components separately.

As a rule, and unlike in the case of financial guarantee contracts, credit derivatives should be classified as derivatives measured at fair value through profit or loss. Therefore, if the reporting entity uses a separate credit derivative to hedge its exposure, a mismatch may arise between the measurement of the financial asset or the loan commitment and the measurement of the credit derivative.

The reporting entity may apply the designation regardless of whether the financial instrument managed in respect of the credit risk falls within the scope of the Standard (such as a loan extended or a financial guarantee contract issued) or alternatively a financial instrument which was excluded from the scope of the Standard (specifically, an excluded loan commitment).

It should also be noted that as per this requirement, the designation for accounting purposes should match the internal management purpose of the reporting entity. In other words, designation is possible only if at the internal level the derivative was, indeed, purchased with the aim of managing the credit risk of the relevant instrument, and not for any other purpose.

3. Name matching

The second condition is that the name of the credit exposure (for example, the borrower, or the holder of a loan commitment provided by the reporting entity) matches the reference entity of the credit derivative. Thus, in our view the condition signifies, among other things, that such designation is not allowed when the credit risk is managed by purchasing index-based CDSs (vs. single-name CDSs), which do not relate to a specific borrower.

4. Seniority level matching

The third condition is that the seniority of the instruments underlying the credit derivative matches that of the managed instrument. That is to say, the credit derivative should not relate to a debt instrument whose seniority level differs from that of the designated instrument. Thus, for example, it is possible that the reporting entity holds a senior debt of a specific borrower (i.e., a debt that has preference over others upon liquidation, or alternatively, a debt that includes pledges and collaterals of significant scope), whereas the credit derivative used by the reporting entity to hedge the credit risk refers to a junior or subordinated debt. Under such circumstances, the reporting entity will not be allowed to designate the credit exposure as at fair value through profit or loss. Nevertheless, in our view, so long as there is seniority matching, this condition does not require that the credit derivative will relate specifically to the same instrument actually held by the reporting entity.

5. Distinguishing between designation of a credit exposure as at fair value though profit or loss and other designation types

Designation of credit exposure as at fair value through profit or loss varies in several respects from other types of financial assets or liabilities’ designation as at fair value through profit or loss as a result of accounting mismatch made possible under the Standard. Specifically, unlike other types of such designation, in the case of credit exposures the reporting entity can make the designation even after initial recognition (but it is required to document the designation). Making the designation after initial recognition of the financial asset or liability is allowed under the Standard due to the dynamic nature of credit risk management. Thus, for example, it is possible that certain loans will become relatively risky at a certain stage of their lifetime, and the reporting entity may deem it fit to purchase a credit derivative in order to manage the credit risk. The credit quality may have improved at a later stage, and the reporting entity opted to sell the derivative.

Another difference lies in the option to designate a proportion of the instrument (for example, a proportion of a single legal loan contract). In addition, in this type of designation the reporting entity is not required to provide reassurance that the profit or loss mismatch will, indeed, decrease. This is due to the fact that when the designation takes place, the changes in the instrument’s fair value (and consequently the reporting entity’s profit or loss) will be impacted not only by the credit exposure (that will be offset by the credit derivative), but also by other market factors that impact the financial instrument, such as market benchmark interest rates, inflation, etc.).

Furthermore, unlike in the case of other designation types that are non-cancelable, the designation of a credit exposure must be discontinued when the qualifying criteria for implementing the designation are no longer met (for more details, see Section 6 below).

6. Accounting for credit exposures designated as at fair value through profit or loss

Upon initial measurement at fair value of a financial instrument designated as at fair value through profit or loss (an event that may take place after initial recognition thereof), or if the relevant instrument was previously not recognised (such as in the case of a loan commitment), the difference at the time of designation between the carrying amount, if any, and the fair value shall be immediately recognised in profit or loss. With regard to financial assets measured at fair value through other comprehensive income, the cumulative gain or loss previously recognised in other comprehensive income shall immediately be reclassified to profit or loss as a reclassification adjustment. It should be noted that in this case as well the principle is maintained whereby the impact as per the statement of profit or loss of an investment in a debt instrument measured at fair value through other comprehensive income shall be identical to the gain or loss (including due to reclassification) that would have arisen had the financial asset been measured at amortised cost.

The reporting entity shall discontinue the fair value through profit or loss measurement of the financial instrument that gave rise to the credit risk, or a proportion of that financial instrument, if the qualifying criteria for the designation are no longer met. For example, if the credit derivative or the related financial instrument that gives rise to the credit risk expires or is sold, terminated or settled. Another situation where the qualifying criteria are no longer met is when the credit risk of the financial instrument is no longer managed using credit derivatives, or if the business model relating to this instrument has changed (even if the instrument, or credit derivative, has not yet expired, sold, settled or terminated). Thus, for example, this could occur because of improvements in the credit quality of the borrower or due to changes to capital adequacy requirements imposed on the reporting entity, such that the reporting entity no longer uses credit derivatives to manage the credit risk.

When the reporting entity discontinues measuring the financial instrument that gives rise to the credit risk, or a proportion of that financial instrument, at fair value through profit or loss, that financial instrument’s fair value at the discontinuation date becomes its new carrying amount. Subsequently, the same measurement that was used before designating the financial instrument as at fair value through profit or loss shall be applied (including amortisation that results from the new carrying amount). For example, a financial asset that had originally been classified as measured at amortised cost would revert to that measurement and its effective interest rate would be recalculated based on its new gross carrying amount on the date of discontinuing the measurement at fair value through profit or loss. It should also be noted that with regard to financial assets, the Standard’s impairment model shall be reapplied on all subsequent reporting dates after the date on which the reporting entity discontinued designating the financial asset as at fair value through profit or loss.

When the designation of a loan commitment that does not fall within the scope of the Standard is discontinued, the Standard does not provide details about the method to be employed in amortising the fair value of the commitment which through that date was recognised over the commitment’s remaining life. In our view, this issue may be addressed by amortising the amount on a straight-line basis, unless it is probable that the loan will be made, in which case, the amount shall be capitalised until it is included in the subsequently recognised loan. In addition, one should bear in mind that under the Standard loan commitments are subject to the impairment model, and in our view, the liability in respect of such commitment shall be measured at the higher of the amortised amount and the impairment provision required.

7. Example – designation of a credit exposure as at fair value though profit or loss

On January 1, 2017, company A (hereinafter – the “Company”) gave a EUR 100,000 loan to company B. The loan bears a 5% interest, payable at the end of each calendar year. The loan principal is payable in a single installment on December 31, 2021. The Company classified the investment in the loan to the amortised cost category.

Due to increase in the loan’s credit risk, on January 1, 2018 the Company purchased a credit derivative in respect of EUR 50,000 par value protection relating to potential insolvency of company B. The seniority level of the said derivative matches that of the loan. It should be assumed that the qualifying criteria for credit exposure designation as at fair value through profit or loss are met for half of the loan amount, and as of that date the Company decides to designate half of the loan amount as at fair value through profit or loss. It should be assumed that as of that date the loan is not considered to be credit-impaired.

On January 1, 2019 the Company sells the credit derivative due to the decrease in the loan’s credit risk, and the qualifying criteria for credit exposure designation as at fair value through profit or loss are no longer met.

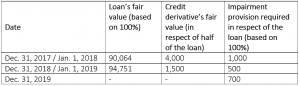

Set forth below are additional relevant data (in Euros):

Set forth below are the journal entries required to account for the above events (in Euros):

As at January 1, 2017

| Dr. investment in loan – amortised cost | 100,000 |

| Cr. cash | 100,000 |

For 2017:

| Dr. cash | 5,000 |

| Cr. interest income | 5,000 |

| Dr. impairment expenses | 1,000 |

| Cr. impairment provision | 1,000 |

As at January 1, 2018:

Purchase of the credit derivative:

| Dr. investment in credit derivative | 4,000 |

| Cr. cash | 4,000 |

Reclassification of half of the loan’s par value to fair value through profit or loss:

| Dr. investment in loan – fair value through profit or loss | 45,032 = 0.5 * 90,064 |

| Dr. provision for impairment | 500 = 0.5 * 1,000 |

| Cr. investment in loan – amortised cost | 50,000 = 0.5 * 100,000 |

| Dr. loss from reclassification | 4,468 |

For 2018:

In respect of the credit derivative:

| Dr. loss from change in fair value | 2,500 = 4,000 – 1,500 |

| Cr. investment in credit derivative | 2,500 |

[It is assumed that the derivative did not include any cash settlement in the period]

In respect of loan proportion accounted for at amortised cost:

| Dr. cash | 2,500 |

| Cr. interest income | 2,500 |

| Dr. provision for impairment | 250 = 0.5 * 1,000 – 0.5 * 500 |

| Cr. income from reversal of impairment | 250 |

In respect of loan proportion accounted for at fair value through profit or loss:

| Dr. cash | 2,500 |

| Dr. investment in loan – fair value through profit or loss | 2,343 = 0.5 * 94,751 – 0.5 * 90,064 |

| Cr. gain from change in fair value | 4,843 |

As of January 1, 2019 (discontinuation of the designation of half of the loan’s par value):

| Dr. investment in loan – amortised cost | 47,375 = 0.5 * 94,751 |

| Cr. investment in loan – fair value through profit or loss | 47,375 |

| Dr. impairment loss | 250 = 0.5 * 500 |

| Cr. impairment provision | 250 |

| Dr. cash | 1,500 |

| Cr. investment in credit derivative | 1,500 |

From this point onwards, the investment in the loan shall be accounted for at amortised cost. While the effective interest rate in respect of the original proportion of the loan (which was not designated as at fair value through profit or loss) is 5%, the effective interest rate in respect of the proportion of the loan that is no longer designated as above will be:

IRR (n = 3; pv = -47,375; pmt = 2,500; fv = 50,000) = 7%.

Set forth below are the journal entries for 2019:

| Dr. cash | 5,000 |

| Cr. interest income | 5,816 (1) |

| Dr. investment in loan – amortised cost | 816 |

| Dr. impairment expenses | 200 |

| Cr. impairment provision | 200 (2) |

(1) 5,816 = 50,000 * 0.05 + 47,375 * 0.07

(2) Since different proportions of the loan have different effective interest rates, in our view the impairment provision should be calculated separately for each such loan proportion, while discounting the expected cash losses using the effective interest rate relevant to each loan proportion. To simplify this example, the amount of the provision was set at a given amount.

(*) (*) This paper was co-authored by Shlomi Shuv and Yevgeni Ostrovsky, CPA, Senior Deputy to the Commissioner of the CMISA and Head of CMISA’s Accounting Division.